The daily cryptocurrency headlines are absolutely surreal.

First we hear that cryptocurrencies like Bitcoin, Dash, and Ethereum are producing digital millionaires and billionaires overnight. Maybe we too should become miners and investors!

And then the next day we hear that these folks have lost it all due to hackers, extreme market volatility, and you know, being robbed by guys with guns. Ok, perhaps we’ll wait this out.

Then we hear the futuristic – and even somewhat apocalyptic – tales that cryptocurrencies will make government-backed currencies obsolete, or even worse, lead to the destruction of sovereign nations!

So what are cryptocurrencies and what should we believe? And what’s this disruptive feature of cryptocurrency you speak of?

What is Cryptocurrency?

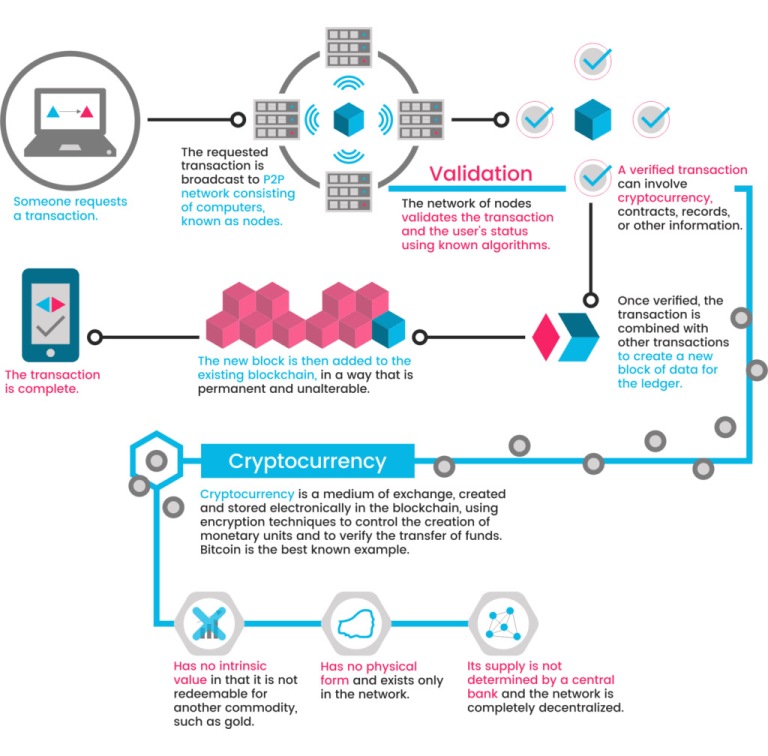

For starters, a cryptocurrency is a digital currency designed to work as a medium of exchange between people. It uses cryptography to secure and verify transactions as well as to control the creation of new units of a particular cryptocurrency.

A key attribute is that it utilizes a decentralized peer-to-peer system to verify transactions, which means that people could exchange goods and services electronically, and anonymously, without having to rely on third parties like banks. Essentially, cryptocurrencies are limited entries in a database that no one can change unless specific conditions are fulfilled.

How Cryptocurrency Works

Examples of Cryptocurrencies

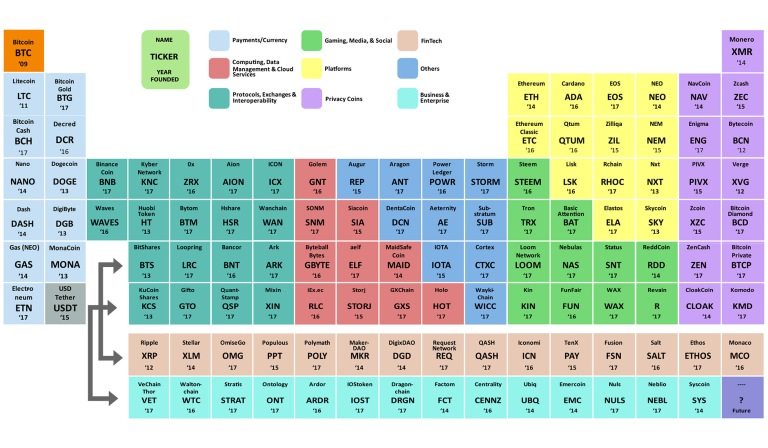

There are roughly 1,700 cryptocurrencies in existence today (view the full list of cryptocurrencies here), although tracking the exact number is increasingly difficult since so many are being created, some are going under, while others are being setup to scam people. But we’ll use this periodic table of cryptocurrency below to display the most prevalent cryptocurrencies on the market today, along with the year they were founded and their purpose (e.g. payments, exchanges, gaming, fintech, etc.). It all started with Bitcoin (top left) in 2009…

The History of Cryptocurrency

During the 90’s tech boom, there were many attempts to create a digital currency with systems like Flooz, Beenz and DigiCash emerging on the market but eventually failing. All of these companies failed due to fraud, financial problems, and even infighting between employees.

During the 90’s tech boom, there were many attempts to create a digital currency with systems like Flooz, Beenz and DigiCash emerging on the market but eventually failing. All of these companies failed due to fraud, financial problems, and even infighting between employees.

Notably, all of those systems utilized a centralized system (or Trusted Third Party approach), meaning that the companies behind them verified and facilitated the transactions. Due to the failures of these companies, the creation of a digital cash system was seen as a lost cause.

Then in 1998, Nick Szabo wrote a paper call “Bit Gold” where he analyzed the origins of money and came to the conclusion that some form of digital world currency, would be the inevitable final evolution of physical cash.

In 2007, Satoshi Nakamoto begins work on Bitcoin and publishes a research paper in October 2008 describing it in detail. In January 2009, Bitcoin version 0.1 was released and the first Bitcoin transaction took place between Satoshi and Hal Finney.

Little did Satoshi realize, but Bitcoin – and other cryptocurrencies – would soon grow into a worldwide phenomenon. Satoshi also didn’t realize that he would also inadvertently create an extraordinary feature of cryptocurrency that would allude the legions of miners, investors, users, and pundits. This feature has yet to be activated, but it’s hidden away and slowly building into a powerful mechanism that will forever change every aspect of society in every country around the world.

And perhaps alter the course of human history.

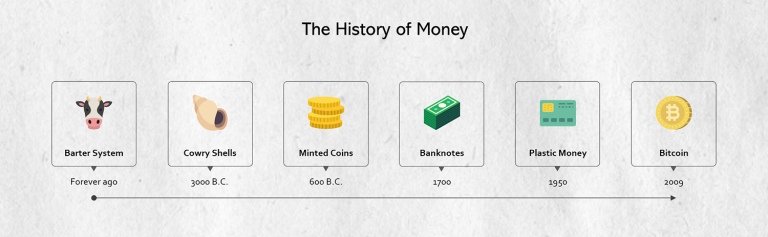

To understand why, you first need to learn about the history of money.

Money is Power

Money is power. Obvi.

Nobody knew this better than the rulers of the ancient world who bestowed on themselves the absolute monopoly on minting money. They minted coins and used it to pay their soldiers, and their soldiers in turn used it to buy things at local stores. The king then sent their soldiers to the merchants and told them to pay their taxes using this money or be killed.

That’s almost the entire history of money in one paragraph. Coercion and control of the supply with violence. The one rule that rules them all. We can see evidence of this all the way back to China’s first emperor, Qin Shi Huang (260–210 BC), who abolished all other forms of local currency and introduced a uniform copper coin.

When power passed from monarchs to nation-states, distributing power from one strongman to a small group of strongmen, the power to print money passed to the state. Anyone who tried to create their own money got crushed.

The reason is simple. Centralized enemies are easy to destroy with a “decapitation attack.” Cut off the head of the snake and that’s the end of anyone who would dare challenge the power of the state and its divine right to create coins.

That’s what happened to e-gold in 2008, one of the first attempts to create an alternative currency. Launched in 1996, by 2004 it had over a million accounts and at its peak in 2008 it was processing over $2 billion dollars worth of transactions.

The US government sought to depose the four leaders, bringing charges against them for money laundering and running an “unlicensed money transmitting” business in the case “UNITED STATES of America v. E-GOLD, LTD, et al.” It destroyed the company by bankrupting the founders. Even with light sentences for the ring leaders, it was game over. Although the government didn’t technically shut down e-gold, it was virtually doomed. “Unlicensed” is the key word in their attack.

The power to grant a license is monopoly power.

E-gold was free to apply for interstate money transmitting licenses, but they had a slim chance of acquiring them. And of course that put them out of business. It’s a living contradiction. And it works every time.

And now we’ve started to see U.S. agencies cracking down on certain aspects of cryptocurrency in the past few weeks. On November 16th, the Securities and Exchange Commission announced its first civil penalties against cryptocurrency founders as part of a wide regulatory and legal crackdown on abuses in the industry. And so it begins, the start of the US government’s attempt to banish cryptocurrency here in the U.S. by finding loopholes to charge founders.

Kings and nation states know the real golden rule: Control the money and you control the world.

And that’s been the blueprint for thousands and thousands of years. Eradicate alternative coins, create one coin to rule them all and use brutality and blood to keep that power at all costs.

In the end, every system is vulnerable to violence.

Well, almost every one.

One thought on “The Truly Disruptive Feature Hidden in Cryptocurrencies That Will Change the World (Part 1 of 3)”